I’ve touched on bid scoping practices in other posts. In this post I’ll attempt to show how professional estimators can dramatically increase the odds of arriving at the winning combination of factors for a successful job in the hard-bid market.

It’s bid day and the clock is counting down to your deadline. The estimate template is complete, the proposal is roughed in, the bid runner’s packet is prepared, all that’s left is to figure out who’s going to build this job with you.

This sure would be easier if everyone would bid early!

As competing bids pile up, it become more and more important to focus on where your attention is needed and even more important on where it’s not. In a perfect world subcontractor bids would arrive days in advance of the deadline allowing leisurely bid review and perhaps even the odd interview or two. The hard bid market will not allow that to happen for three main reasons.

“The driver? Oh yeah, he went ahead on foot…muttered something about … faster that way…”

High speed

First of all, hard-bid jobs mean there are competing firms in the running. The less selective the client is about who may compete, the more competition a job stands to have. Clients putting work out to hard-bid are seeking to use market pressure to lower prices. One means of increasing the pressure is to reduce the amount of time to prepare a bid. I’ve lost count of how many addenda answered “no” to a bidders request for more time.

Major drag

The second reason subcontractors bid at the last-minute is to limit opportunity for bid shopping. A new-lowest bid delivered 5 minutes before the deadline leaves just enough time to carry their proposal but not enough to get a conspirator to beat it. Supply chain vendors and product representatives delay their bids to prevent subcontractor level bid-shopping as well. Some play “king-maker” by giving only favored subs a timely proposal, leaving the rest to trail in after the deadline. Estimators are well advised to reconcile themselves to the existence of corruption in their market. Chasing work involving dirty players means you’ll encounter more last-minute and late bidders. Working with and for honest people has the opposite effect.

Pedestrian on the highway

The third reason is that the bulk of a subcontractors bid effort is going to last-minute, high pressure deadline races. Interrupting that packed pipeline of obligations to send in a proposal way early for GC convenience is like asking for a deli counters wine list during the lunch rush! Leisurely bidding is completely foreign to hardscrabble subcontractors. It smacks of dilettante privilege and conveys a lack of commitment to a common struggle for work.

I should also point out that the corrupt people I’ve encountered were entitled raconteurs with all the time in the world. If you’ve got the luxury of time, be careful of how you appear to your bidders lest they get the wrong impression!

“No, no, I see what you’re saying…”

As time runs out, focus shifts from need to want

Most estimators start and end bid scoping from opposing perspectives. To start, estimators are worried that the bidders missed something that leaves them exposed to risk. Everything is compared to the quantity take offs (QTO’s) and discrepancies are noted for follow-up. As more competing bids arrive, it becomes necessary to focus efforts on only the lower priced options. When the deadline is fast approaching, the focus becomes exclusively about deciding whether to take the lowest price (and higher risk) compared to other options. Time is no longer a luxury, it’s a liability.

Knowing at the forefront that you’ll need to make difficult decisions that the last moment, it’s critical to consider the relative merit of every scoping effort from the very beginning. For example; painters notoriously send in hand scribbled bids with “paint everything” and a dollar total next to it. On an average remodel, paint is typically much less expensive than other trades. That means that paint bids will have little impact on your odds of winning that particular job. Opting to carry a slightly higher paint bid from a known-good subcontractor allows the estimator to move on to more influential trades. Following up after the bid may put a little extra funding in the project if a lower paint bid is legitimate. Generally speaking, low dollar impact subs shouldn’t command as much of your time.

Ankle biters can take you down

However there is a catch; if you’ve got project with very limited scope for a given trade, there’s a good chance that subcontractors won’t bid on it because it’s too small. For example, many remodel projects require roof penetrations for Mechanical, Electrical, and Plumbing trades. Very often these new penetrations will require the attention of a roofer to maintain the existing roof’s warranty. A Roofer couldn’t be reasonably expected to go through every page of a drawing set looking for piecemeal work to bid. If there isn’t a roofing plan, they’re going to ignore the bid entirely, especially if they’re busy. It’s up to the estimator to pull these limited scope issues out and directly contact necessary bidders to get coverage. Simple piecework like roof penetrations are often quoted over the phone or via email. Don’t wait till bid day because you’ll surely be leaving voice-mails for people who are out of the office till after your deadline!

Savvy estimators work out mutually acceptable “menu pricing” with trusted subs for items like this so they’ve got a solid plug number in their bids. Make sure you stay up-to-date on those subs because they might be swamped with peak season work and unable to get to your little job.

Fancy footwork

Some estimators request “scope letters” in markets where subcontractors traditionally withhold their numbers until the last moment. These are roughed in proposals with “To Be Determined” in the place of a dollar amount. Ideally these proposals allow estimators time to verify that all scope inclusions and exclusions conform to their expectations. In practice, these generate a “running game” where estimators are asking subcontractors for adders, deducts, and alternates to a total bid amount they haven’t seen. Since all scope letters are “technically equal” this means that the estimator is all but guaranteed to waste time on bidders who never stood a chance of winning.

Doing something stupid to counter something stupid, does not make stupid things wise.

The practice is cheating the GC’s out of time to make informed decisions on the grounds that they can’t be trusted with the subcontractor’s best effort. Cheating for fear of being cheated is hardly the modus operandi of an esteemed professional. Subcontractors should simply stop bidding to cheaters. Let nature take its course removing them from the market. If a GC would willfully hurt your business on a typical bid, imagine how savage they’d be if your bid had a mistake!

“I’m not sure if this counts as a problem or a solution!”

GC’s asking for these scope letters should be working towards building trust with market-leading subcontractors. Often that means committing to working with only a few bidders in that trade. If they are truly market leader subs, the GC would only lose the hack and high bidders that gum up the works. This practice requires diligent checks of market pricing to keep their short-listed subs honest.

Trouble brewing

Beyond the short-sighted practice of working for corrupt people, there’s a quiet risk, gathering like a storm cloud over everyone involved. Contract case-law underpins the why’s and wherefore’s of the entire project cycle. All too often bidders assume that whatever is in their contract is the legal boundary of their situation regardless of any mistakes. In fact, there are legal provisions that allow for contract relief due to an honest error in their bid.

Many GC’s operate on the misguided notion that “plausible deniability” is sufficient to excuse them of their obligation to thoroughly review subcontractors bids. Contracting with the apparent low despite suspicious differences in price is a difficult position to defend in court because it lacks “good faith”. If something looks too good to be true to a judge, it won’t end well for anyone who foolishly contracted upon it.

Nuclear option

Court cases are generally the most costly option for companies to resolve a dispute which means there’s an incentive for all parties to be reasonable. GC’s who bid-shop may lose their claim to compensation because they acted in bad faith. Subcontractors who agree to bid shopping may likewise lose their claims to compensation for the same reason. Court cases are rarely simple and a great many factors influence how a particular case will unfold. Being honest, professional, and forthright is easier to defend however the best defense is to never conduct business with dishonest people. Not winning a job is less risk to your firm than depending upon a court battle to eventually deliver justice.

Vampires must be invited in

It’s really common to hear about the importance of relationships in business. While it’s undeniable that human endeavors will revolve around relationships, much of the individual’s success depends on their ability to see beyond their individual circle. Some firms or people will cheat you just because they can. Looking back at firms that cheated me I can recall that most of them cheated me after I’d done my first job. They didn’t cheat me on that first job. In fact, I recall being told my firm was something of a hero on those jobs because nearly every other trade was under-performing, falling down, or outright sabotaging the job.

Game time

Now it’s obvious to me that a firm who bid-shops, cheats, and undercuts their subcontractors would naturally have projects staffed with surly, uncooperative, and under-performing contractors. That firm only hired legitimately low bidders on their first project. All projects after that first one ended up with a call to “help them out of a jam” . Promises to make it up elsewhere were empty. The “relationship” established on that first job was a pretext for cheating the uninitiated.

Subcontractors do the same thing. Many times a new subcontractor would deliver very competitive prices right from the start. Those first jobs would often go without a hitch but following projects would have gradually increasing change orders for scope items they’d previously never mentioned. Estimators are well advised to stay appraised of what their Project Managers’ are facing to keep the bidders from gaming the bid scoping. It’s terrifically common for a subcontractor to be much more compliant for the Estimator than for the Project Manager.

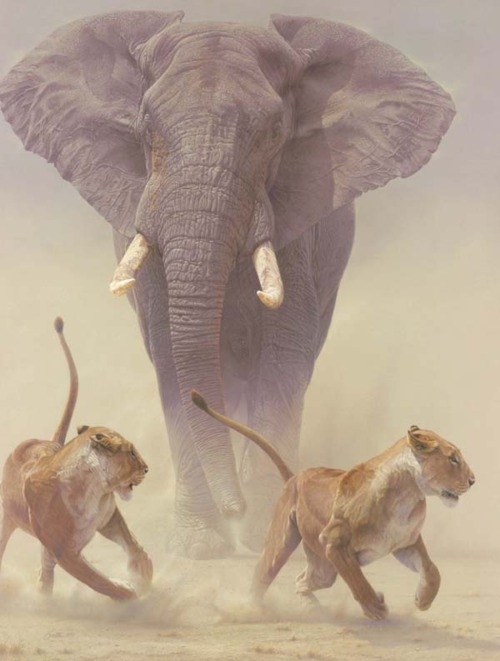

Ethical Bidding and Pacifism don’t mix

Losing an honest bid is an acceptable (if disappointing) outcome; professionals will concede the victory with grace and decorum. Make no mistake, the bid is no friendly raffle for charity! Losing a bid has consequences for all involved. Many people focus on “not hurting anyone” as a guidepost to their professional endeavors. Often this leads to honest estimators validating a dishonest win by maintaining stoic silence.

Too many professionals feel they “don’t have a dog in the fight” even as their local market constricts further every year. Hard bidding means that the (often poor) odds of winning are countered by the bidders good faith expectation that a legitimate winner will receive a contract. It’s therefore in the interest of all honest bidders to ensure that legitimacy.

Tradesman shortages and market declines are all partly attributable to short-sighted greed that honest people meet with diffidence. The truth is an amplifier, and you’ve much to lose by giving ground to the lowest operators. Conversely, some of my most cherished business relationships come from a shared commitment to beating the cheaters by working together. It’s immensely satisfying to land a good job with reputable firms knowing the cheater was in hot pursuit.

Throw the stink-bomb back.

Sometimes markets will reward bad behavior in the short-term. Bid shopping GC’s abound during market downturns when subcontractor options are limited. This doesn’t mean that we have to go along peacefully. Entirely too much of public bidding is concealed by professional silence. Nobody can act against cheating because nobody will say what’s going on.

Anonymously notifying a competitor that they’re being shopped helps to stem the practice without putting a target on your back. GC’s that lose because they opted not to carry an illegitimate subcontractor bid should QUICKY make their bid results public to give their responsible subs a shot at notifying the winning GC and/or client of the problem. Beware that spreading gossip and misinformation will sully your reputation in the long run. Stick to the truth and be forthright with everyone.

Don’t count on any three or four letter acronym trade organizations to do anything, every cheater I’ve encountered was an active member of at least a half-dozen of them. It’s not necessarily the organizations fault, these people will happily perjure themselves to stockpile credentials against their legacy of deceit. Nevertheless, these associations are antithetical to their purpose if they won’t part with charlatans.

“Oh yeah Bob’s an ass…wait, he’s standing right behind us again isn’t he? Everybody just act natural!”

To reverse decline, it must become fashionable for honest people to doing the right thing.

Bidders are a motivated bunch with many intersecting channels of communication. The individual fears of being “exposed” as the whistle-blower might be weighed against a developing reputation for being unable to compete at market value. There are lots of people losing bids because they don’t know what they’re doing. Nobody’s knocking on their door with good opportunities as a result. Subs aren’t motivated to “help” a GC who won’t level the playing field for everyone (including themselves). After a while these GC’s will get courtesy bids that maintain the appearance of trying, while allowing the sub to get on to more viable opportunities. It’s not long before the GC can’t win even fair contests because they’ve become irrelevant.

The next time a proposal lands on your desk, consider how your actions in that moment, will go on to define your future and the market where you’ve made your home. Make your part of the skyline something to be proud of.

For more articles like this click here

© Anton Takken 2014 all rights reserved